The "Assets" module allows you to keep track of your fixed assets like machinery, land, and building. The module allows you to generate monthly depreciation entries automatically, get depreciation board, sell or dispose assets and perform reports on your company assets.

As an example, you may buy a car for $36,000 (gross value) and you plan to amortize it over 36 months (3 years). Every month (periodicity), Flectra will create a depreciation entry automatically reducing your assets value by $1,000 and passing $1,000 as an expense. After 3 years, assets account for $0 (salvage value) in your balance sheet.

The different categories of assets are grouped into "Assets Categories" that describe how to depreciate an asset. Here are examples of assets Categories:

- Hardware: 3 years, yearly linear depreciation

- Car: 5 years, monthly linear depreciation

- Electronics: 6 years, yearly linear depreciation

Configuration

Install the Asset module

Start by installing the Asset module.

Once the module is installed, you should see new menus in the accounting application:

Before registering your first asset, you must define your Asset Categories.

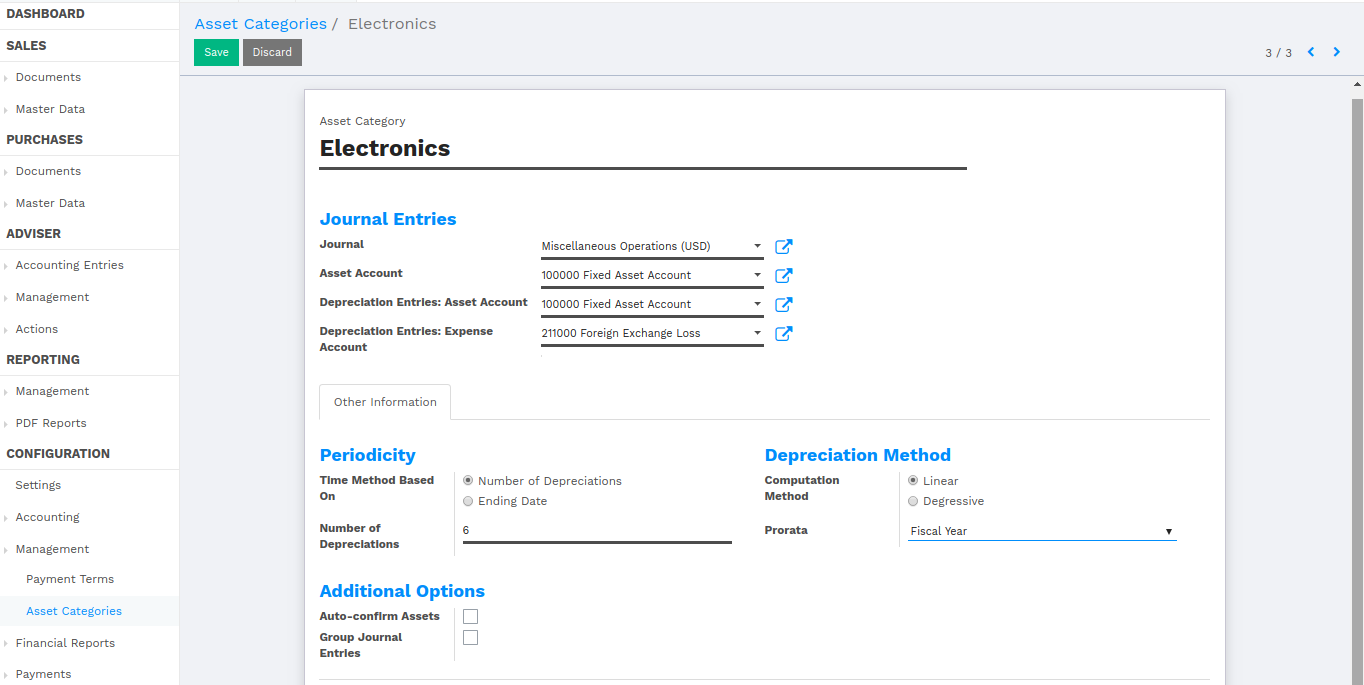

Defining Asset Categories

Asset categories are used to configure all information about an assets: asset and depreciation accounts, amortization method, etc. That way, advisers can configure asset categories and users can further record assets without having to provide any complex accounting information. They just need to provide an asset category on the supplier bill.

You should create asset categories for every group of assets you frequently buy like "Cars: 5 years", "Computer Hardware: 3 years". For all other assets, you can create generic asset categories. Name them according to the duration of the asset like "36 Months", "10 Years", ...

To define asset Categories, go to

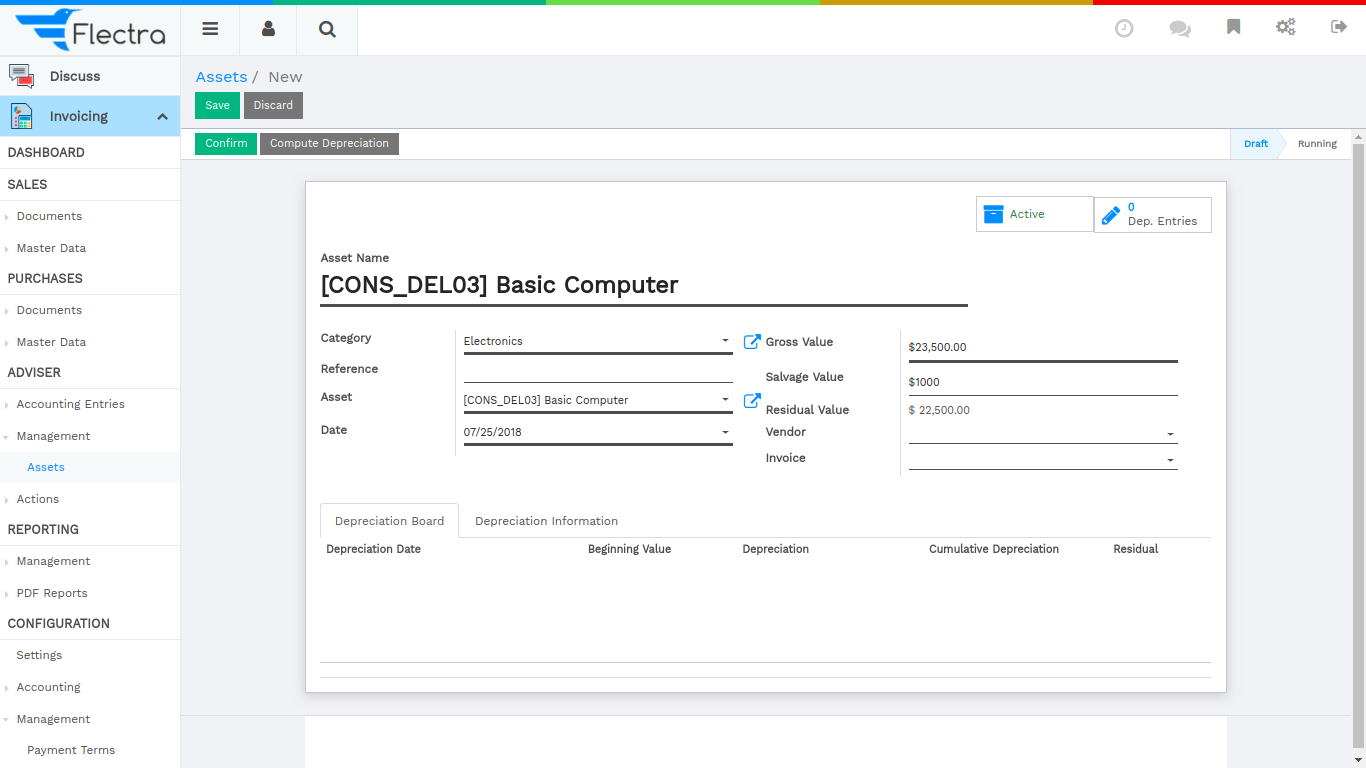

Create assets manually

To register an asset manually, go to the menu .

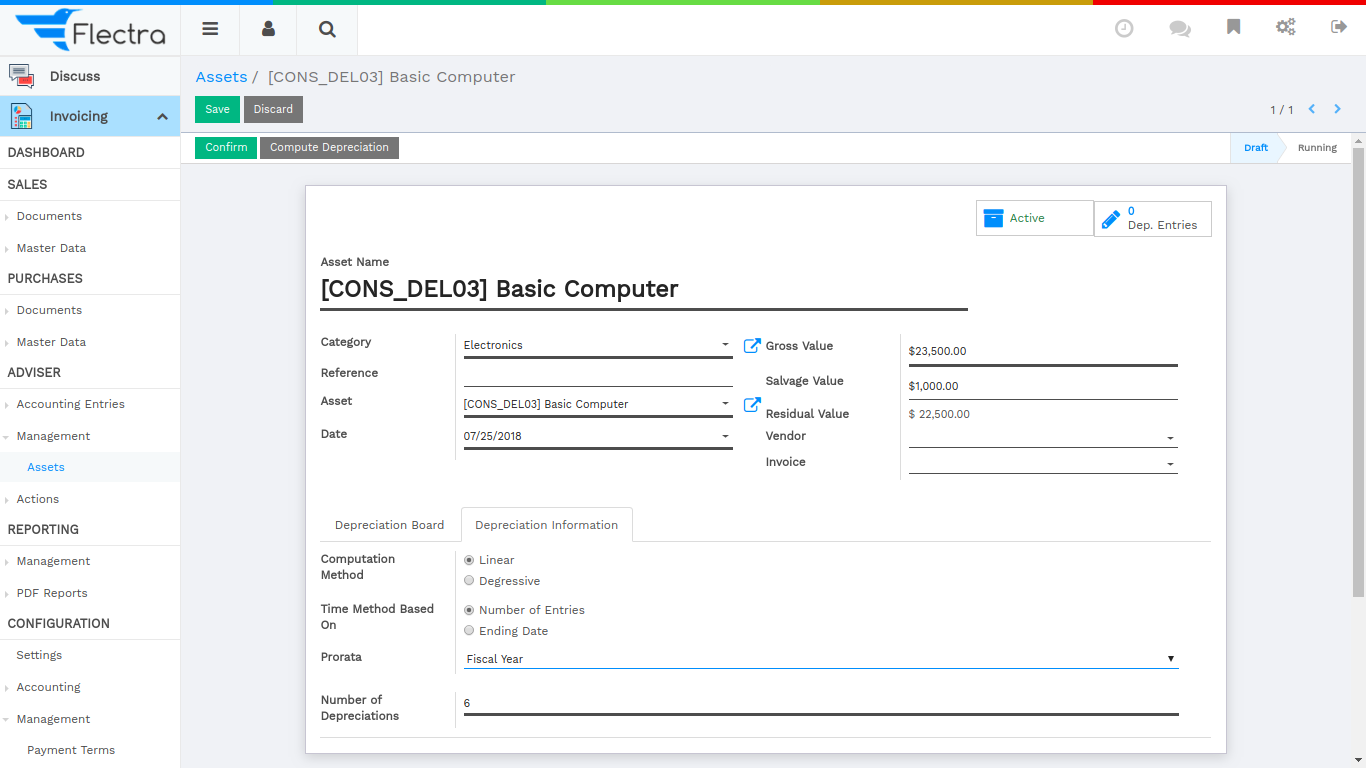

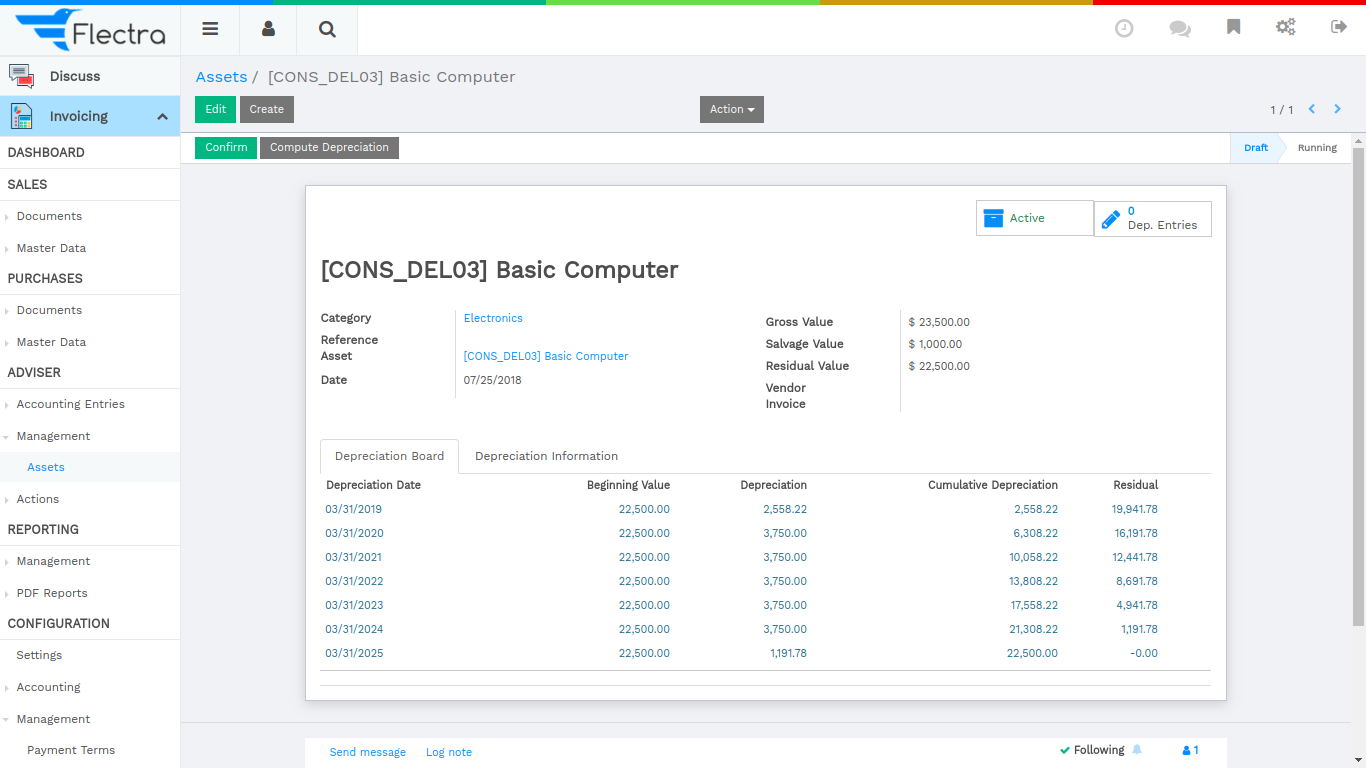

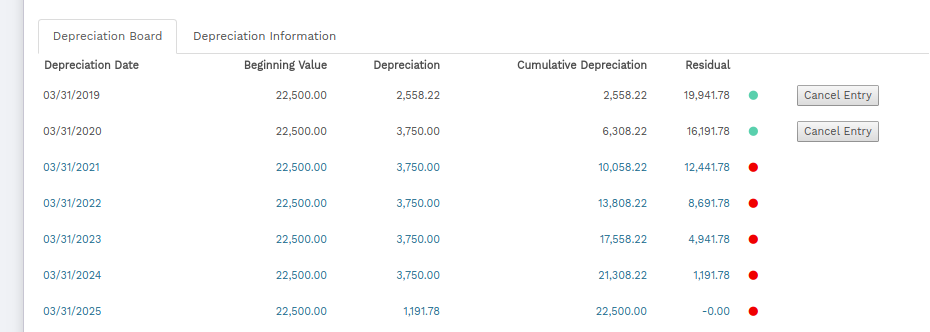

Once your asset is created, don't forget to Confirm it. You can also click on the Compute Depreciation button to check the depreciation board before confirming the asset.

Here deprecation date is set fiscal year date wise because we have set [UNKNOWN NODE title_reference] as [UNKNOWN NODE title_reference]. After confirmed assets.

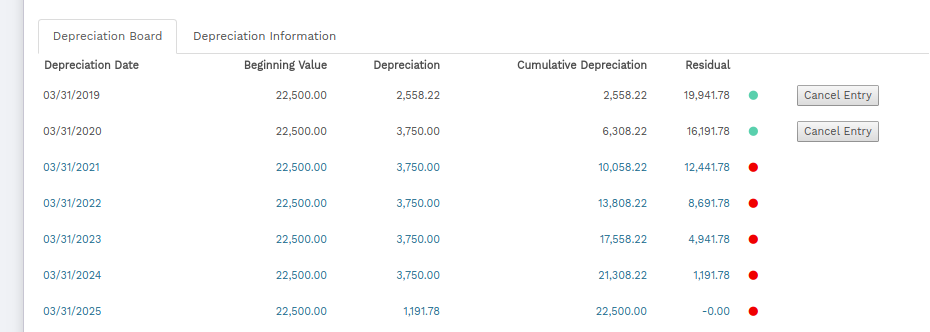

You can also cancel deprecated line using click on Cancel Entry button.

Tip

if you create asset manually, you still need to create the supplier bill for this asset. The asset document will only produce the depreciation journal entries, not those related to the supplier bill.

Explanation of the fields:

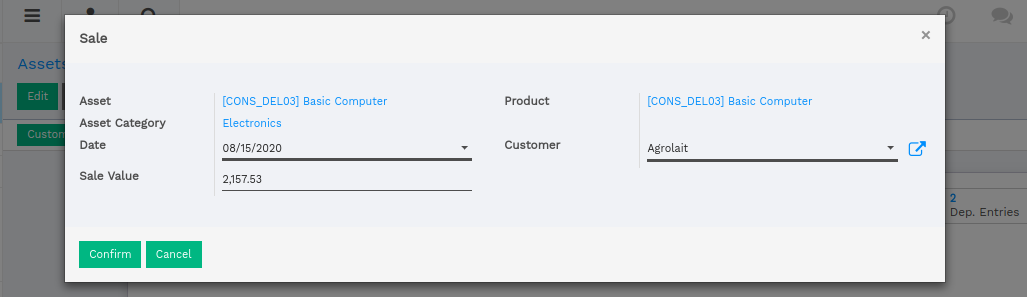

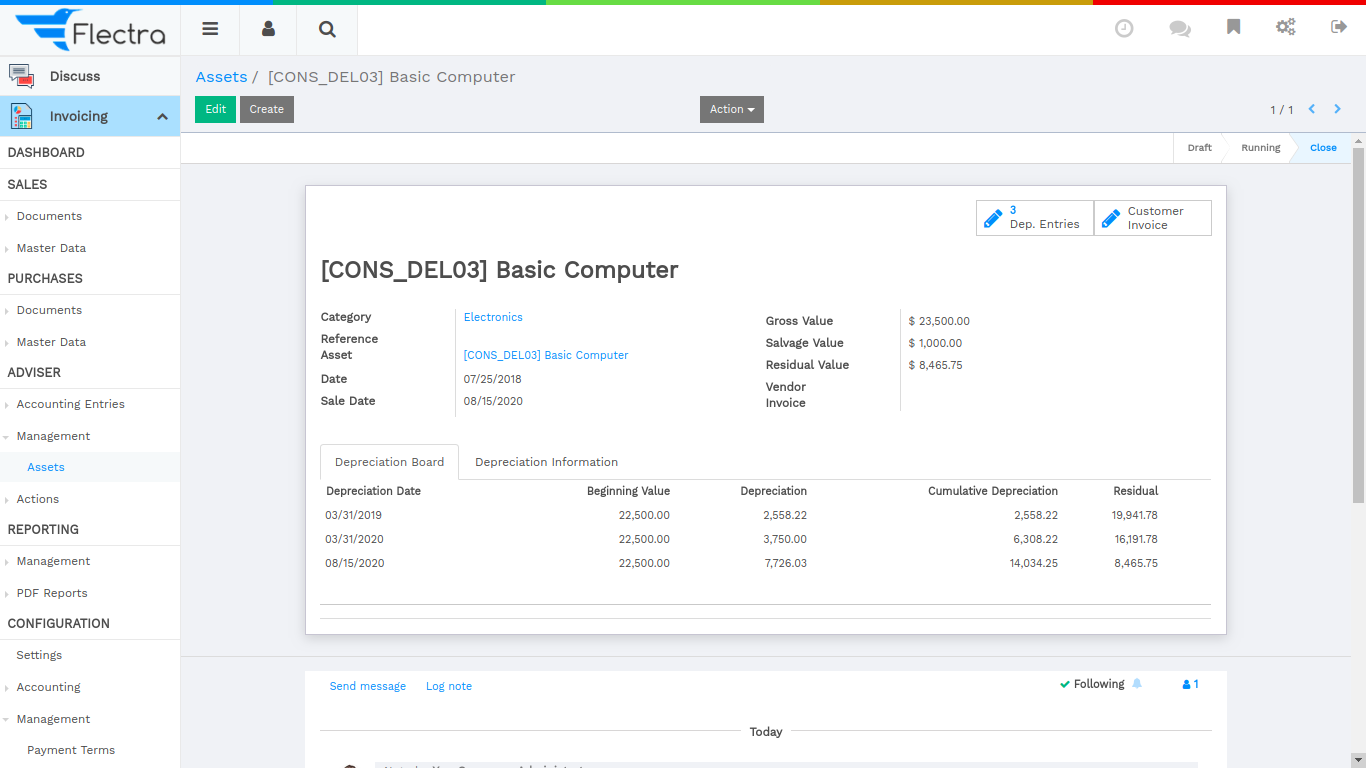

Sale Asset

We can sale asset directly to the particular customer

- Date: Define here asset sale date.

- Sale Value: It will calculate the amount by default Date wise.

Here remove other depreciations line which is greater than Date. You can also view Customer Invoice button.

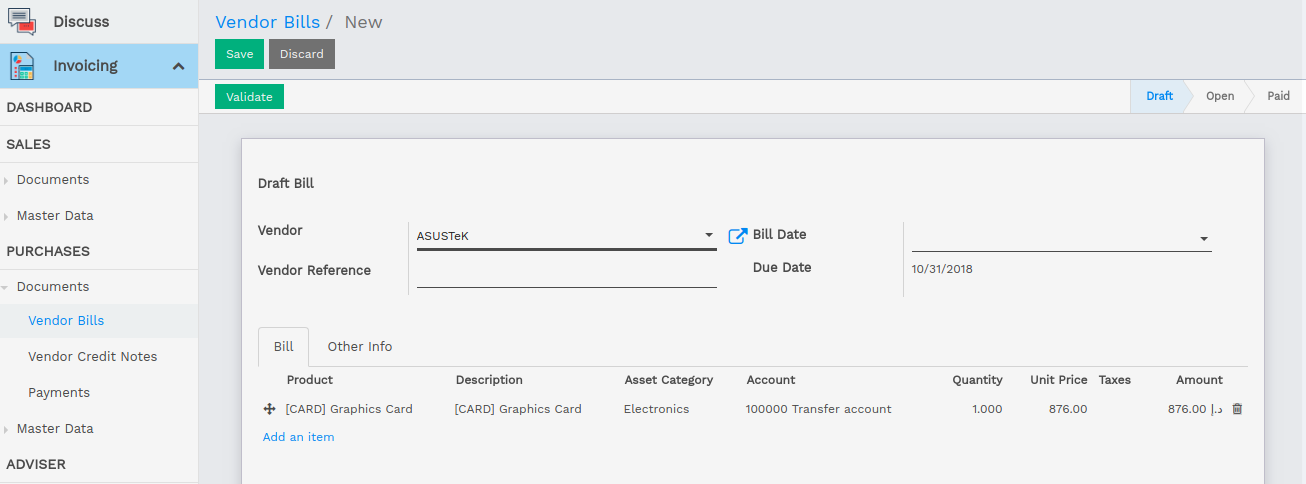

Create assets automatically from a supplier bill

Assets can be automatically created from supplier bills. All you need to do is to set an asset category on your bill line. When the user will validate the bill, an asset will be automatically created, using the information of the supplier bill.

Depending on the information on the asset category, the asset will be created in the draft or directly validated. It's easier to confirm assets directly so that you won't forget to confirm it afterward. (check the field Skip Draft State on Asset Category) Generate assets in draft only when you want your adviser to control all the assets before posting them to your accounts.

Tip

if you put the asset on the product, the asset category will automatically be filled in the supplier bill.

How to depreciate an asset?

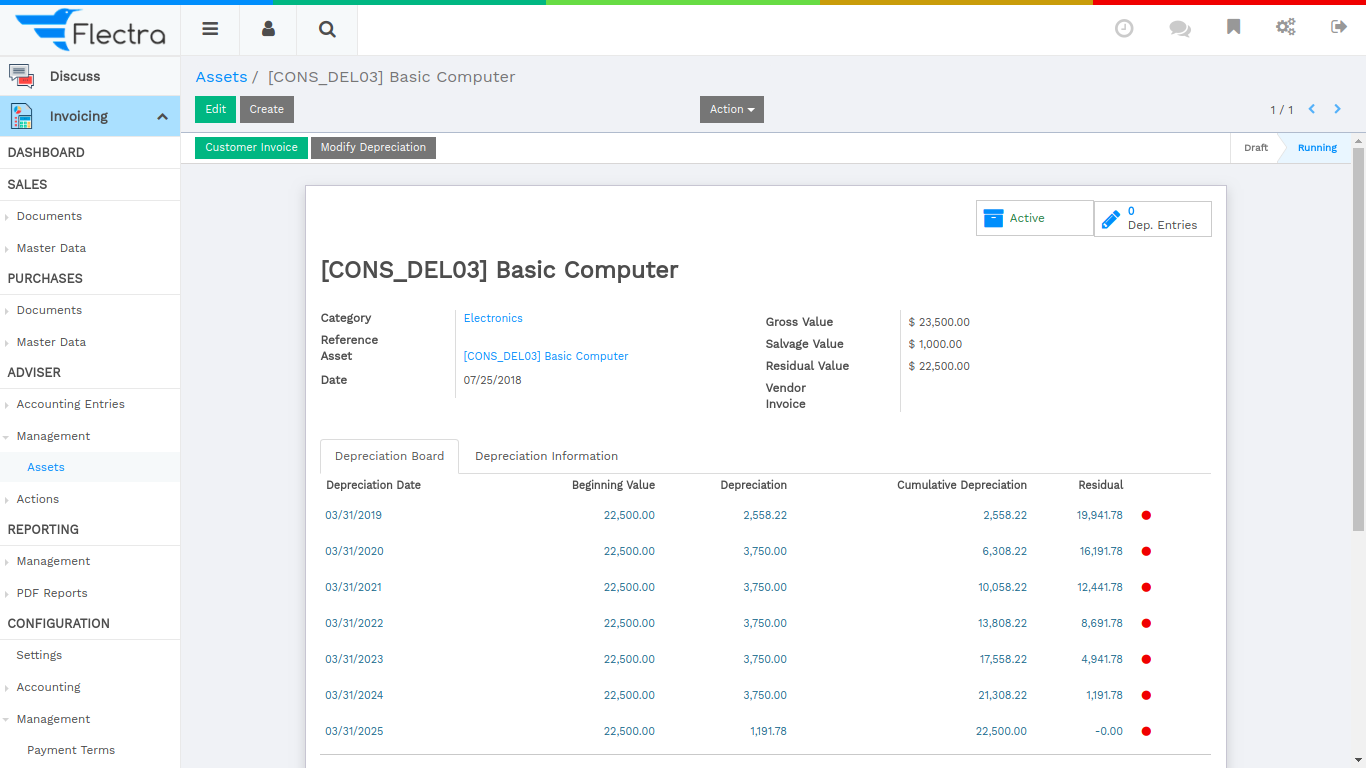

Flectra will create depreciation journal entries automatically at the right date for every confirmed asset. (not the draft ones). You can control in the depreciation board: a green bullet point means that the journal entry has been created for this line.

But you can also post journal entries before the expected date by clicking on the green bullet and forcing the creation of related depreciation entry.

Note

In the Depreciation board, click on the red bullet to post the journal entry. Click on the Items button on the top to see the journal entries which are already posted. You can also cancel deprecated line using click on Cancel Entry button.

How to modify an existing asset?

- Click on Modify Depreciation

- Change the number of depreciation

Flectra will automatically recompute a new depreciation board.

How to record the sale or disposal of an asset?

If you sell or dispose of an asset, you need to deprecate completely this asset. Click on the button Sell or Dispose. This action will post the full costs of this assets but it will not record the sales transaction that should be registered through a customer invoice.

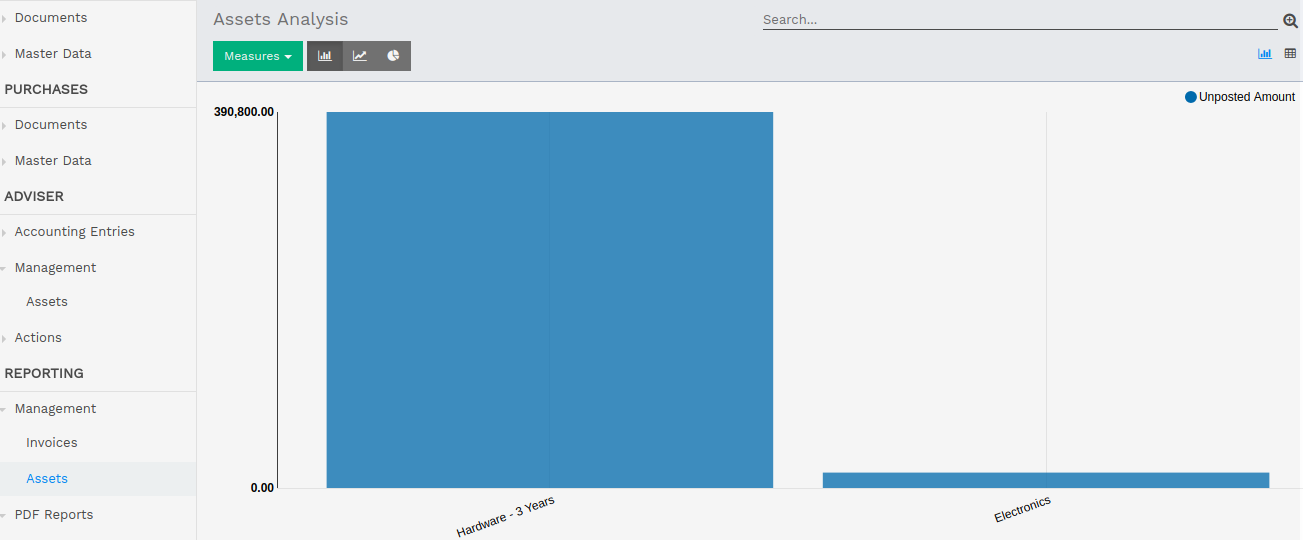

Reports

Analysis Report

This report display graph view data of remaining depreciated amount.

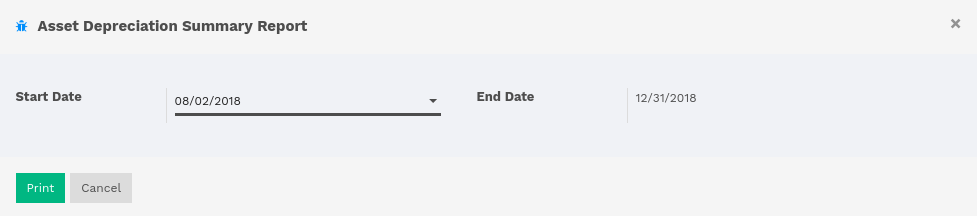

Summary Report

You can print summary report of asset from Start date to End date.